Students from the University of Stuttgart built an electric car. And no, it’s not some ultralight vehicle designed to win an eco-marathon. It is a racetrack machine designed to leave practically all motorcycles — and practically all production cars — in the dust.

GreenTeam’s car. Photo: GreenTeam Uni Stuttgart

GreenTeam’s car. Photo: GreenTeam Uni Stuttgart

There are certain vehicles that GreenTeam’s car simply cannot compete with. Dragsters. Rocket sleds. Jet-powered and rocket-powered cars. Hovever, the Stuttgart-based team’s all-electric creation easily outruns Lamborghinis, Ferraris, Porsches and Formula 1 cars.

It has just set a Guinness World Record for the fastest-accelerating electric car. The 0–62 mph (0–100 km/h) time is about 1.46 seconds. Well, 1.461 to be exact.

The vehicle, designated E0711–11 EVO, competes in Formula SAE/Formula Student (yes, a vehicle built for student contests accelerates faster than an actual Formula 1 machine). For the Guinness World Record attempt, the vehicle apparently lost its huge rear wing it previously had.

Performance through light weight

The vehicle has four in-wheel electric motors. According to the team’s website, they are putting out 210 hp (156.4 kW) — but apparently, in the vehicle used for the world record attempt, it was beefed up to 241 hp (180 kW).

Does not seem much? Well, the weight of the carbon-fiber-bodied car is 173 kg (381 lb), and for the world record attempt it was reduced even further — Carscoops says the weight is 145 kg or 320 lb.

Which means the power-to-weight ratio is astounding (I think the fact that the vehicle is electric also plays a role — an ICE car probably wouldn’t have achieved such results with the same power-to-weight ratio).

That obviously brings to mind Lotus cars with their “performance through light weight” design. For Germans, it probably evokes the memories of the Bergspyder. The Bergspyder, developed by Porsche in the late 1960s, was a machine competing in hill climbing races, and had its weight reduced to the minimum.

There is yet another way to look at it: it’s a slightly oversized go-kart — an electric one, and with an extremely high power output. Although in the Guinness World Record run it only demonstrated its straight-line acceleration, so that result alone does not indicate whether the vehicle’s handling is truly go-kart-like.

See the Guinness World Record attempt video here.

The battery size is only 7 or 8 kWh (according to the team’s website), which partially explains the low weight. For a racing machine that lasts longer on the track, you might want to look up the Ariel Hipercar.

___

Sources: [1][2]

Some German cities have already accumulated sizable numbers of EVs.

Frankfurt. Photo: Matthias Konrath

Frankfurt. Photo: Matthias Konrath

Replacing ICE cars with electric vehicles is a slow process.

Just because electric vehicles are selling well doesn’t mean they constitute a large part of the overall vehicle fleet. Cars (and trucks) have a long service life. And what you see on the road is a reflection of how the auto market looked like years ago — not how it looks like right now.

So it takes years before high sales of EVs translate into a reasonably high proportion of EVs on the road.

Example: in Germany, the market share of electric vehicles (BEVs+PHEVs) exceeds 30% in some months. The share of such vehicles in the German passenger vehicle fleet, however, is more like 3%.

Just to be clear, in this article, the “vehicle fleet” means all the vehicles that are there. It has the same meaning as the term “the total number of vehicles on the road”.

3% for BEVs+PHEVs. 1.6% for BEVs only (at the end of H1 2022). But in some cities, including Frankfurt and Stuttgart, it’s considerably more than that.

Before we get to discussing Frankfurt and Stuttgart (or you can just scroll down to the part about Frankfurt and Stuttgart), an explanation why there are such disparities between different parts of Germany.

The EV share of the market does not vary that much state to state…

In the United States, it’s easy to point out which states have a high EV market share — California definitely stands out.

Compared to the United States, Germany looks like a monolith. When it comes to EV market share, differences between states are quite small.

But the EV share of the fleet varies a lot state to state

And yet, some German states have more than twice the percentage of EVs on the road (in their vehicle fleets) than others.

Maybe some states got on the EV bandwagon earlier than others? Actually, that’s not the most important reason. The real reason is something else:

The “turnover rate” of cars and SUVs varies a lot from state to state.

In some areas — especially those with thriving automotive industry, and in richer regions in general — customers treat cars and SUVs like single-use items. They buy or lease a brand new vehicle; and then, before the vehicle starts to look dated, they get rid of it and get a new one. In such areas, new car/SUV sales remain at a high level, and the existing fleet of vehicles is getting replaced quite quickly. In the state of Bavaria, 4–5% of the passenger vehicle fleet is 9 months old or less.

In other areas, customers are less likely to buy brand new vehicles. They buy used; or just keep their own vehicles longer. In the state of Mecklenburg-Vorpommern, only 2–3% of the passenger vehicle fleet is 9 months old or less.

It’s not that people in areas like Mecklenburg-Vorpommern are significantly less likely to buy electric if they go to a car showroom. It’s just that they are less likely to go to a showroom at all. Which is why it will take longer for things that are common in car showrooms — like electric vehicles — to become common on the streets too.

(Yes I know that buying an all-electric vehicle in a showroom sound like an antiquated idea; in the explanation above, “car showroom” = new vehicle market.)

Frankfurt

Frankfurt. Photo: Epizentrum

Frankfurt. Photo: Epizentrum

Frankfurt, with its skyscraper-packed center, is the financial capital of Germany; it is also home to the country’s largest airport. 7.0% of passenger vehicles registered in the city are plug-in electric. 3.1% are BEVs and 3.9% are PHEVs.

That is about 24,300 vehicles (plug-in electric), about 10,800 vehicles (BEVs) and about 13,500 vehicles (PHEVs), respectively.

Stuttgart

Stuttgart. Photo: Fanndian (edited by Pro2)

Stuttgart. Photo: Fanndian (edited by Pro2)

Stuttgart hosts the headquarters of both Mercedes-Benz and Porsche (the latter might be more associated with the name Zuffenhausen, but Zuffenhausen is a district of Stuttgart). 7.5% of passenger vehicles registered in the city are plug-in electric. 3.2% are BEVs and 4.2% are PHEVs. These numbers don’t seem to add up, but it’s because of rounding.

That is about 22,400 vehicles (plug-in electric), about 9,700 vehicles (BEVs) and about 12,700 vehicles (PHEVs), respectively.

Both in Frankfurt and in Stuttgart, PHEVs outnumber BEVs. In Germany as a whole, it is the other way around — the fleet of all-electric vehicles is already larger than the fleet of PHEVs.

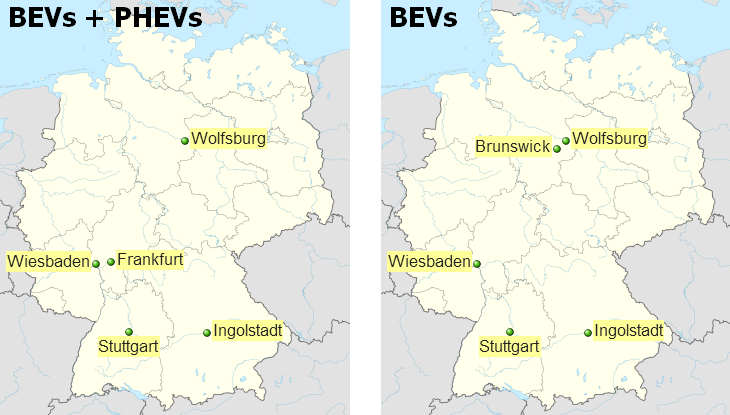

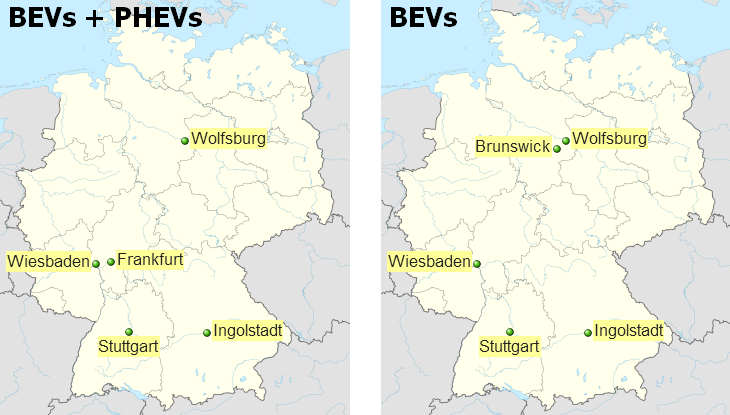

Did I mention that areas with thriving automobile industry, or just rich areas, have a higher vehicle “turnover rate”, which causes EVs to become common on the roads more quickly? Here are the top 5 German registration circuits — all of them happen to be cities — with the highest share of electric vehicles in their fleets. One map shows the statistics for all plug-in vehicles (BEVs+PHEVs); the other one, for BEVs only.

Wiesbaden

Wiesbaden, not very far from Frankfurt, has hot springs and a large U.S. Army garrison.

Importantly, Wiesbaden is the city with the highest share of plug-in vehicles in Germany (9.2%). Also, it is the city with the highest share of BEVs (5.2%). PHEVs are 4.0%.

The idea that it’s some small spa town would be wrong. Wiesbaden has some 200,000–300,000 people and a high car ownership rate (the number of vehicles per capita is higher than the state average, and much higher than in Franfurt). A lot of vehicles and a high proportion of them being all-electric mean than the number of BEVs — that’s BEVs only — in Wiesbaden actually exceeds 10,000.

Ingolstadt

Audi’s hometown also boasts more all-electric vehicles than PHEVs.

6.5% of passenger vehicles in Ingolstadt are plug-in electric. 3.8% are BEVs, 2.7% are PHEVs.

Wolfsburg and Brunswick

Wolfsburg is a name long associated with the automotive giant Volkswagen — which might create the impression that it’s a bigger city than it really is. In fact, Wolfsburg is home to about 125,000 people. But it did not even exist as a city before 1938, when the Nazi program of mass-producing a people’s car (the Beetle) started. For a company town, it’s quite large.

Brunswick is a bigger and older city which, for historical reasons, shares its name with many places in the Americas and in Australia (kind of like the English city of York does). And yes, Volkswagen also has its facilities in Brunswick.

In Wolfsburg, 7.3% of all passenger vehicles are plug-in electric. 3.1% are BEVs, 4.2% are PHEVs.

Brunswick seems to be more BEV-oriented. 6.2% of all passenger vehicles are plug-in electric; 4.4% are BEVs, 1.8% are PHEVs.

___

Sources: KBA fleet data for the end of H1 2022 [1][2], KBA registration data [3][4]

The Tata Nexon EV crossover was selling remarkably well in H1 2022.

Tata Nexon EV. Photo: Ratopati TV

Tata Nexon EV. Photo: Ratopati TV

In India, the market share of all-electrics (BEVs) among passenger vehicles is low. In the first half of the year, it was roughly 1%.

But the overwhelming majority of those sales are scored by just one brand: Tata. Basically, the Indian BEV market is even more Tata-centric than the American BEV market is Tesla-centric.

The name does not ring any bells? Well, Tata Motors happens to own 100% of Jaguar Land Rover (acquired in 2008), but the Tata brand itself was never popular in Europe — despite some forays into the European market; and in North America, it is practically unknown. In its home country, it’s different: Tata is a major, and long-established, player in the Indian passenger vehicle market.

And in the first half of 2022, about 7% of passenger vehicles sold by Tata in India were all-electric.

It’s just two all-electric models: the Tata Nexon EV crossover SUV (30.2 kWh or 40.5 kWh) and the Tata Tigor EV small sedan (26 kWh).

In the first half of the year, 13,280 units of the Nexon EV were sold — and 5,532 units of the Tigor EV (For comparison, in the first half of the previous year, these figures were merely 3,204 and 222, respectively). That sums up to 18,812 units, although Tata’s own monthly reports show 18,378.

The Nexon EV is the more interesting of the two models. It is still a small vehicle, about 4 m (157 inch) long. Front-wheel drive only, like most subcompact crossovers. The variant with a 40.5-kWh battery, designated “Max”, packs 143 hp, accelerates from 0 to 100 km/h (0–62 mph) in under 10 seconds, and has a top speed of 140 km/h or 87 mph.

That variant costs the equivalent of US$22,300.

The Nexon — the gasoline variant, not the electric one — scored 5 stars out of 5 in a Global NCAP crash test, a first for an Indian vehicle (as of 2022, it is no longer the only one with such a rating). But make no mistake, it still has only 2 airbags. And Global NCAP crash tests are much more lenient than the current Euro NCAP test procedure.

At the end of September, Tata unveiled a third model, the Tiago EV. The Tiago is a hatchback counterpart to the Tigor sedan. The EV variant is a vehicle with a 19.2-kWh battery selling for the equivalent of $10,350 (or a vehicle with a 24-kWh battery selling for $12,150). It is marketed as the most affordable EV in India.

And Tata’s competitor Mahindra is preparing an offensive of all-electric SUVs. The first one is the XUV400, with a roughly 40-kWh battery.

Where are Tesla and BYD?

Well, they are abroad — in the sense that they don’t make all-electric vehicles in India. And the Indian car market is prety tightly insulated from foreign imports. There are high import tariffs — 60% or 100%, depending on the value of the car.

Tesla is simply absent from the Indian market (although there are private imports), and BYD sells very small numbers of all-electric passenger vehicles each month.

Electric motorcycles are booming in India

Here’s a little fact about the Indian car market: every year, Indians buy about 10–20 times less cars and light trucks per capita than Americans, Germans or the French. It might have something to do with how India is not as rich as these countries.

This is partially (but only partially) compensated by huge sales of motorcycles and scooters. Here are the statistics for a certain period of 12 months (these are not statistics for the first half of the year):

• passenger vehicles: ~ 3 million

• commercial vehicles: ~ 0.7 million

• three-wheelers: ~ 0.3 million

• two-wheeled vehicles: ~ 13 million

Yes, 13 million motorcycles and scooters per year — compared to 3 million passenger vehicles.

And the sector of motorcycles and scooters is undergoing electrification: the market share of all-electric vehicles varied from 2.8% to 4.5% over the first six months of 2022 (excluding low-speed vehicles — so electric kick scooters are not inflating these statistics).

Some 400,000 “high-speed” electric motorcycles and scooters were sold in H1 2022, compared to some 20,000 electric passenger vehicles. You can see which type of vehicle is more popular.

Among three-wheelers (which are not included in the statistics for motorcycles and scooters), the share of all-electrics in H1 2022 was roughly 50%. Yes, about half of them. Although it’s half of a surprisingly small market — three-wheelers, though they are a common sight on roads, are not currently selling in India as well as you might think. As a result, two-wheeled electric motorcycles and scooters are actually outselling electric three wheelers.

___

Sources: [1],[2],[3],[4]

The market share of plug-in vehicles reached 24.2%. BEVs were 15.9%, PHEVs were 8.2%.

Renault Megane E-Tech Electric. Photo: Matti Blume

Renault Megane E-Tech Electric. Photo: Matti Blume

Among passenger vehicles, all-electrics outsold diesels last month. This is the first time it happened in France, at least in this century.

Also: at 15.9%, the market share of all-electrics set a new record (surpassing December 2021).

Top 10 all-electrics, September 2022:

1. Renault Megane E-Tech Electric (2897 units)

2. Tesla Model 3 (2202 units)

3. Dacia Spring (2170 units)

4. Peugeot e-208 (2129 units)

5. Renault Twingo (1387 units)

6. Fiat 500e (1269 units)

7. Tesla Model Y (1261 units)

8. Renault Zoe (1117 units)

9. Peugeot e-2008 (867 units)

10. Volkswagen ID.3 (632 units)

It was an end-of-quarter month, a “Tesla month” in which large shipments of Teslas usually arrive in Europe (of course the Model Y is now also made locally). There was a hiccup in June — some European markets got a smaller number of vehicles than usual. While Tesla’s French deliveries are up in September compared to June, it’s not a Tesla model that is the real star of this ranking.

About 2900 units of the Megane E-Tech Electric were delivered in September — the best monthly result for this model so far. Introducing this generation of the Megane as an all-electric vehicle, without any ICE counterpart, turned out to be a good bet by Renault.

Renault sold more BEVs than Tesla last month — and that’s not counting Renault-owned Dacia. The Renault Zoe and the Dacia Spring are finding customers despite their crash test results.

Top 10 PHEVs, September 2022:

1. Peugeot 3008 PHEV (894 units)

2. Citroen C5 Aircross PHEV (846 units)

3. Peugeot 308 PHEV (597 units)

4. Mercedes GLA PHEV (576 units)

5. DS7 PHEV (535 units)

6. Mercedes GLC PHEV (496 units)

7. Hyundai Tucson PHEV (432 units)

8. Audi Q3 PHEV (424 units)

9. Kia Niro PHEV (397 units)

10. BMW X3 PHEV (379 units)

Four French models in the top 5. Also, the Mercedes GLA PHEV outsold the GLC PHEV this time.

The market year to date (Jan-Sep 2022)

Here are the results year to date (all figures according to AAA Data).

Top 10 all-electrics, year to date (Jan-Sep 2022):

1. Peugeot e-208 (14108 units)

2. Dacia Spring (13022 units)

3. Fiat 500e (12454 units)

4. Renault Twingo (10702 units)

5. Renault Zoe (10632 units)

6. Tesla Model 3 (10265 units)

7. Renault Megane E-Tech Electric (9154 units)

8. Tesla Model Y (5974 units)

9. Peugeot e-2008 (5481 units)

10. Hyundai Kona Electric (4781 units)

Top 10 PHEVs, year to date (Jan-Sep 2022):

1. Peugeot 3008 PHEV (7938 units)

2. Peugeot 308 PHEV (4778 units)

3. Mercedes GLC PHEV (4603 units)

4. Citroen C5 Aircross PHEV (4377 units)

5. Hyundai Tucson PHEV (3231 units)

6. DS7 PHEV (3193 units)

7. BMW X3 (2831 units)

8. Kia Sportage (2519 units)

9. Mercedes GLA (2308 units)

10. Volvo XC40 PHEV (2305 units)

Looking at the entire passenger vehicle market (both plug-in and non-plug-in vehicles), there was a year-over-year increase in monthly sales in September 2022. Of course non-plug-in vehicles still constitute the majority of the market.

___

Sources: [1],[2],[3],[4],[5]

If the same applied to the United States, there would be over thirty million electric cars and light trucks on U.S. roads. Obviously the U.S. is not there yet.

A Tesla Model S in Norway. Photo: Mario Duran-Ortiz

A Tesla Model S in Norway. Photo: Mario Duran-Ortiz

Let’s be accurate: 1 vehicle per 10 people is the best approximation of the prevalence of all-electric light vehicles in Norway, if you want to express it in the form of 1 vehicle per [integer number] of people.

One per ten is the best approximation. Not one per nine, not one per eleven.

The exact point at which the number of such vehicles exceeds 1/10 of the population has not been passed yet — but it’s close.

You hear phrases like “Norway leads the world in EV adoption”, but that’s an understatement. Right now Norway is not just leading, it is well ahead of the rest of the pack. There is no other country like this in the world. Iceland might be the second best (might be — I didn’t check), but compared to Norway, it has less than half as many all-electric vehicles per population.

It is a matter of money, of course. Norway has extremely high taxes on ICE cars, but none or close to none on pure electric vehicles.

Which BEVs are most popular?

Norway is a land of Teslas, right? The country that will buy as many electric cars as Tesla can ship?

Well, Teslas and electric vehicles from the Volkswagen Group are now both popular.

Tesla flooded the Norwegian market with Model 3s in 2019, but in 2020 it was the Audi e-Tron (the SUV) that was the best-selling vehicle; the Model 3 regained the first place the following year. And now, the Model Y is directly competing with the Volkswagen ID.4 and its siblings. The Model Y is topping the sales charts so far this year — but if you combine the sales of the ID.4 and it siblings together, then they are outselling Tesla’s crossover.

A Volkswagen ID.4 in Norway. Photo: Tomm W. Christiansen, motor.no

A Volkswagen ID.4 in Norway. Photo: Tomm W. Christiansen, motor.no

There are now more than 500,000 all-electric light vehicles in Norway, that milestone was passed this year (now we are talking about all registered vehicles, not just about those sold this year). Not bad, given that the 50,000 mark was passed only in April 2015… The most common one of them (over 70,000 vehicles) is still the good old Nissan Leaf. A nice thing about the Leaf — now well into its second generation — is how it was resistant to price increases affecting EVs over the last 1–2 years (maybe it helps that the development costs are probably long paid off). I hope Nissan — which is about to start raking profits on the new Ariya — won’t start raising prices of the Leaf now, or stop its production.

The numbers

The number of all-electric light vehicles registered in Norway reached 525,993 as of 30 June 2022. The population of Norway was 5,455,582. One all-electric light vehicle per 10.37 people.

Out of these 525,993 all-electric light vehicles, 508,565 were passenger vehicles; the rest were light commercial vehicles.

A Tesla Model S in Norway. Photo: u/VegarHenriksen on Reddit

A Tesla Model S in Norway. Photo: u/VegarHenriksen on Reddit

___

Sources: [1],[2],[3],[4]

GreenTeam’s car. Photo: GreenTeam Uni Stuttgart

GreenTeam’s car. Photo: GreenTeam Uni Stuttgart Frankfurt. Photo:

Frankfurt. Photo:  Frankfurt. Photo:

Frankfurt. Photo:  Stuttgart. Photo:

Stuttgart. Photo:

Tata Nexon EV. Photo:

Tata Nexon EV. Photo:  Renault Megane E-Tech Electric. Photo:

Renault Megane E-Tech Electric. Photo:  A Tesla Model S in Norway. Photo:

A Tesla Model S in Norway. Photo:  A Volkswagen ID.4 in Norway. Photo:

A Volkswagen ID.4 in Norway. Photo:  A Tesla Model S in Norway. Photo:

A Tesla Model S in Norway. Photo: